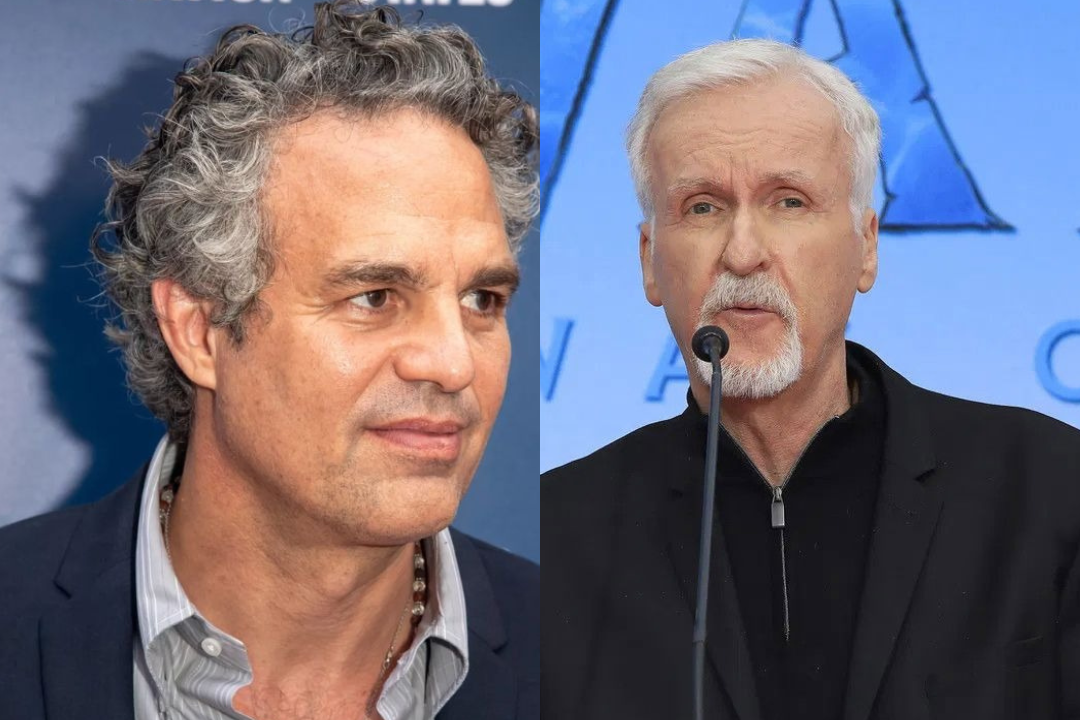

Mark Ruffalo Calls Out James Cameron’s Selective Outrage Over Netflix Amid Paramount Bid War

For months, the proposed Netflix-Warner Bros. Discovery transaction has unfolded as a high-stakes chess match between balance sheets and boardrooms. From early exploratory talks to antitrust modeling and valuation recalibrations, the contours of the deal have largely been shaped by CEOs, bankers, and regulatory counsel. But just as the financial engineering seemed to dominate the discourse, the creative community entered the arena.

And then, unexpectedly, another voice cut through the noise. Mark Ruffalo stepped into the conversation, not with a press release, but with questions.

Mark Ruffalo fires back: A question of consistency

ADVERTISEMENT

Article continues below this ad

Mark Ruffalo’s intervention reframed the debate. If James Cameron is alarmed about monopolization, Ruffalo suggested, should not that scrutiny apply universally?

“So… the next question to Mr Cameron should be this…” he posited: “Are you also against the monopolization that a Paramount acquisition would create? Or is it just that of Netflix?”

The implication was clear, if consolidation is the enemy, it cannot be selectively condemned. Ruffalo pressed further: would Cameron oppose a Paramount-led takeover with equal vigor? Would Sen. Mike Lee scrutinize that scenario with the same intensity?

“We all want to know,” Ruffalo added, positioning himself as speaking on behalf of “hundreds of thousands of filmmakers worldwide.”

In a pointed letter to Sen. Mike Lee, legendary filmmaker James Cameron warned that a Netflix acquisition of Warner Bros. Discovery’s studio and streaming assets could devastate the theatrical model. The director of Titanic likened the future of cinemas to a “sinking ship,” arguing that consolidation under a streaming-first giant risks fewer releases, job losses, and structural damage to one of America’s most valuable cultural exports.

Yet the story did not end there. As speculation mounted, Paramount reemerged as a potential counterweight, reigniting volatility around Warner Bros.’ future.

Paramount’s shadow bid

With regulators scrutinizing Netflix’s ambitions, industry chatter suggests that Warner Bros. Discovery has reconsidered alternative pathways, including renewed dialogue with Paramount Global. Paramount’s own consolidation calculus, amid leadership shifts and asset evaluations, complicates the narrative that Netflix alone represents monopolistic risk.

ADVERTISEMENT

Article continues below this ad

At the same time, Netflix leadership continues to defend the transaction publicly, emphasizing scale efficiencies, global distribution strength, and capital investment in content. The regulatory review process, particularly under antitrust oversight, remains a decisive variable. Lawmakers could hold additional hearings, and rival bidders may yet influence valuation and timing.

In the end, this is no longer just a financial story. It is a referendum on the future of theatrical exhibition, creative labor, and media consolidation.

ADVERTISEMENT

Article continues below this ad

Where do you stand? Share your perspective on whether Netflix’s bid safeguards or sinks Hollywood’s future.

ADVERTISEMENT

Edited By: Hriddhi Maitra

ADVERTISEMENT

ADVERTISEMENT